DSE works to improve education for children with Down syndrome everywhere

We work to discover how and why development differs for children with Down syndrome, and how we can best help them to achieve their potential.

We deliver evidence-based resources around the world that help families and professionals to provide effective teaching approaches and interventions.

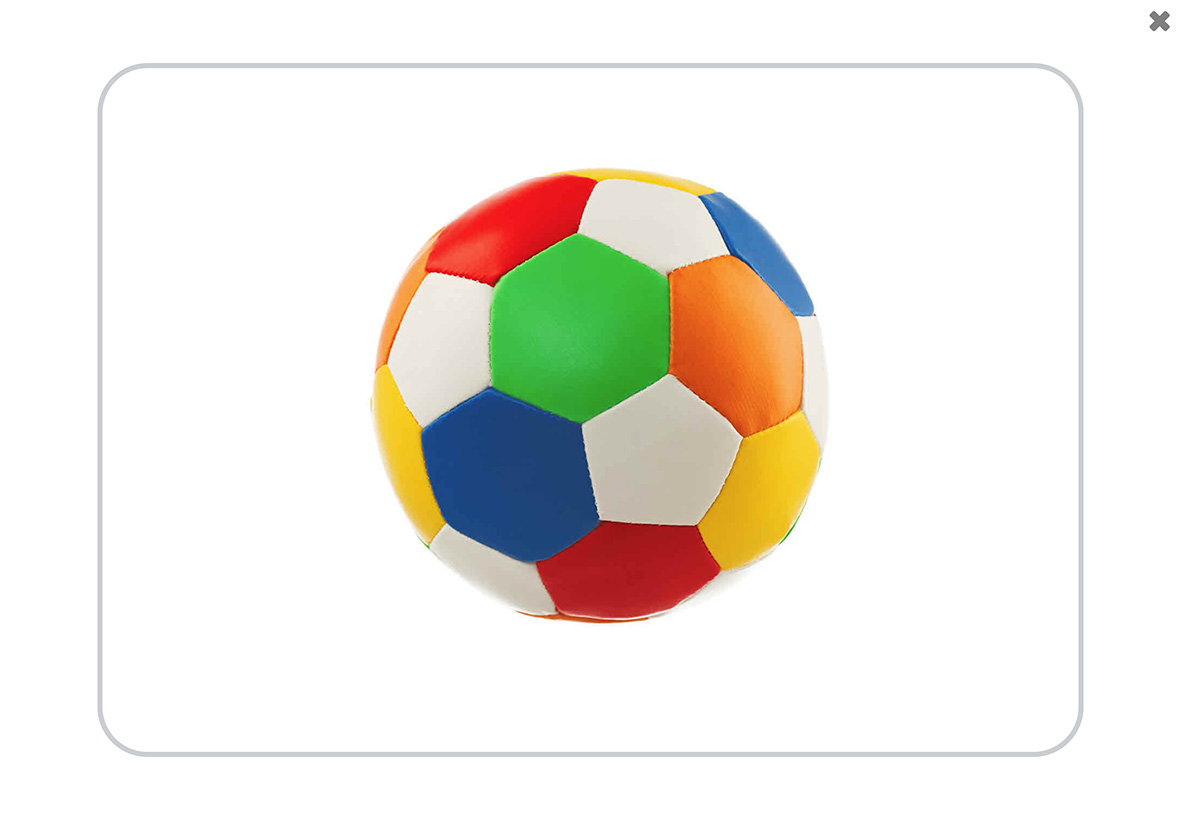

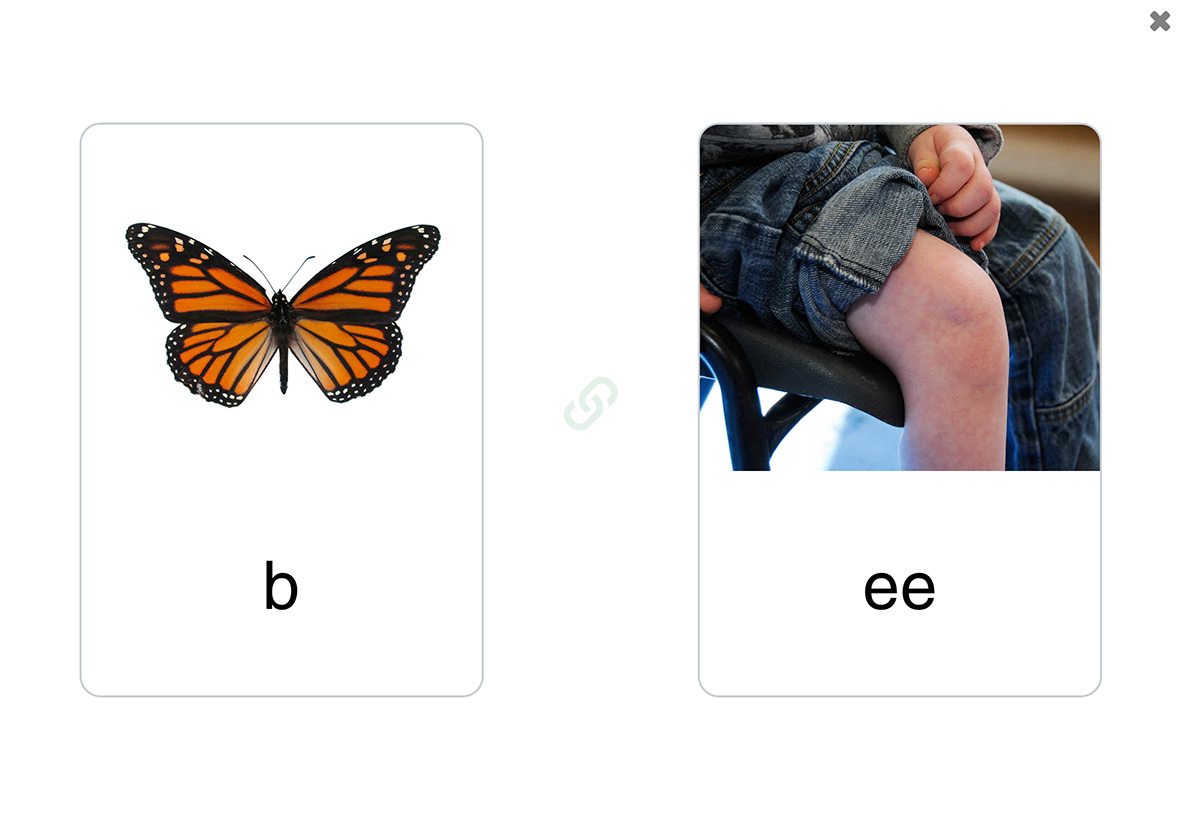

See and Learn

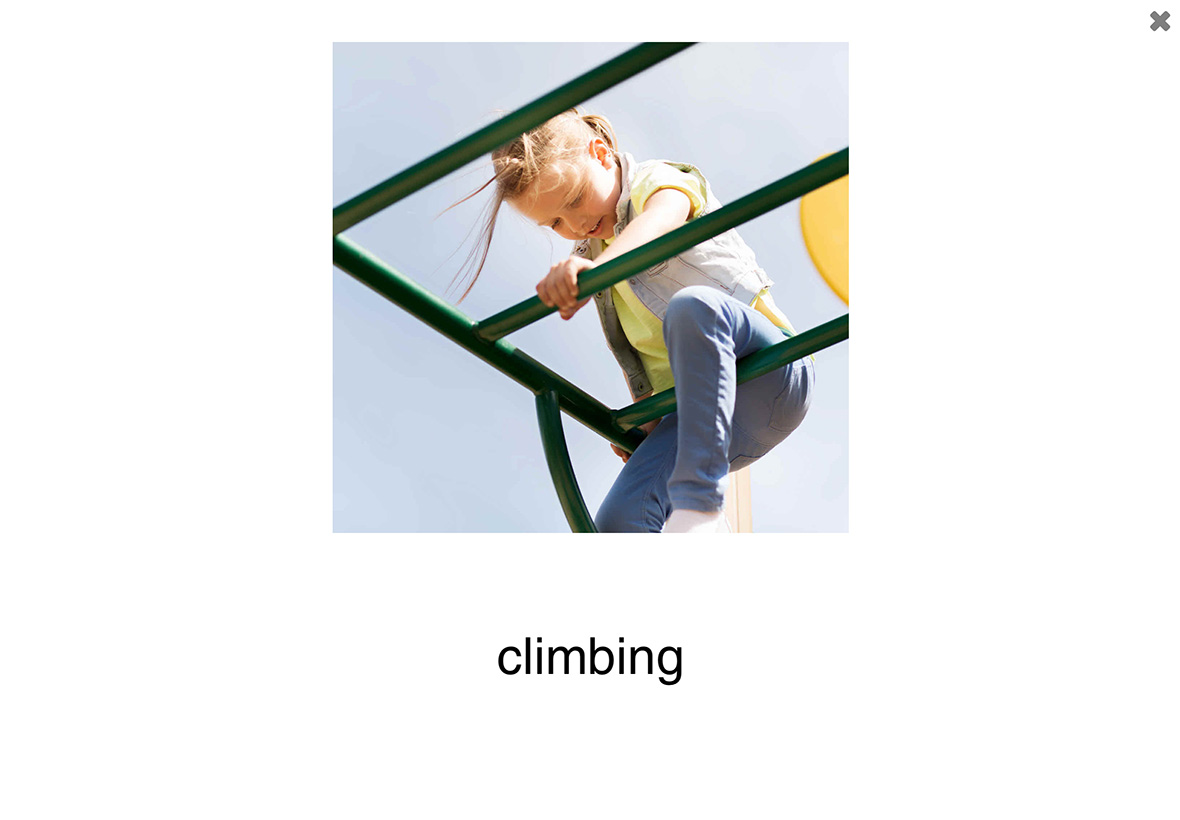

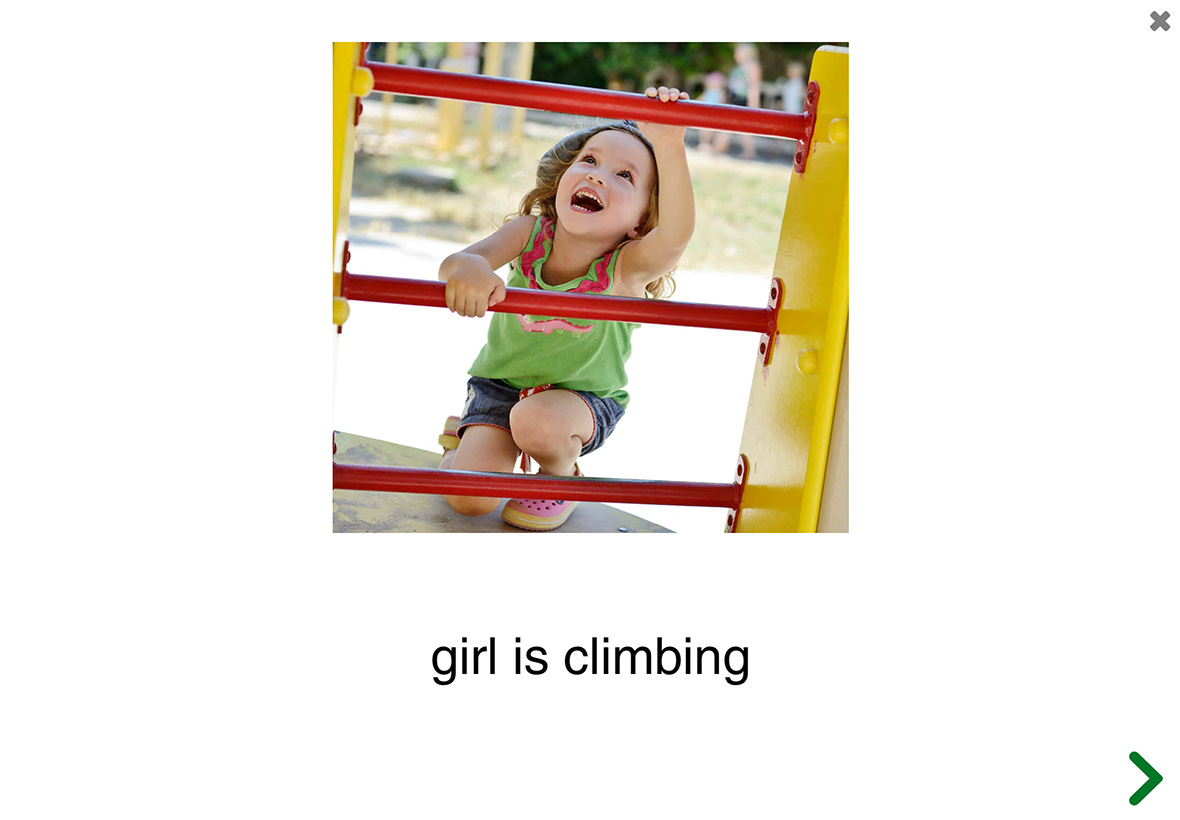

See and Learn offers carefully structured, evidence-based activities and guidance to help children to speak more clearly, to communicate more effectively and to learn to count.

See and Learn can be used to help children learn foundational speech, language, reading and numeracy skills from birth through to the early school years.

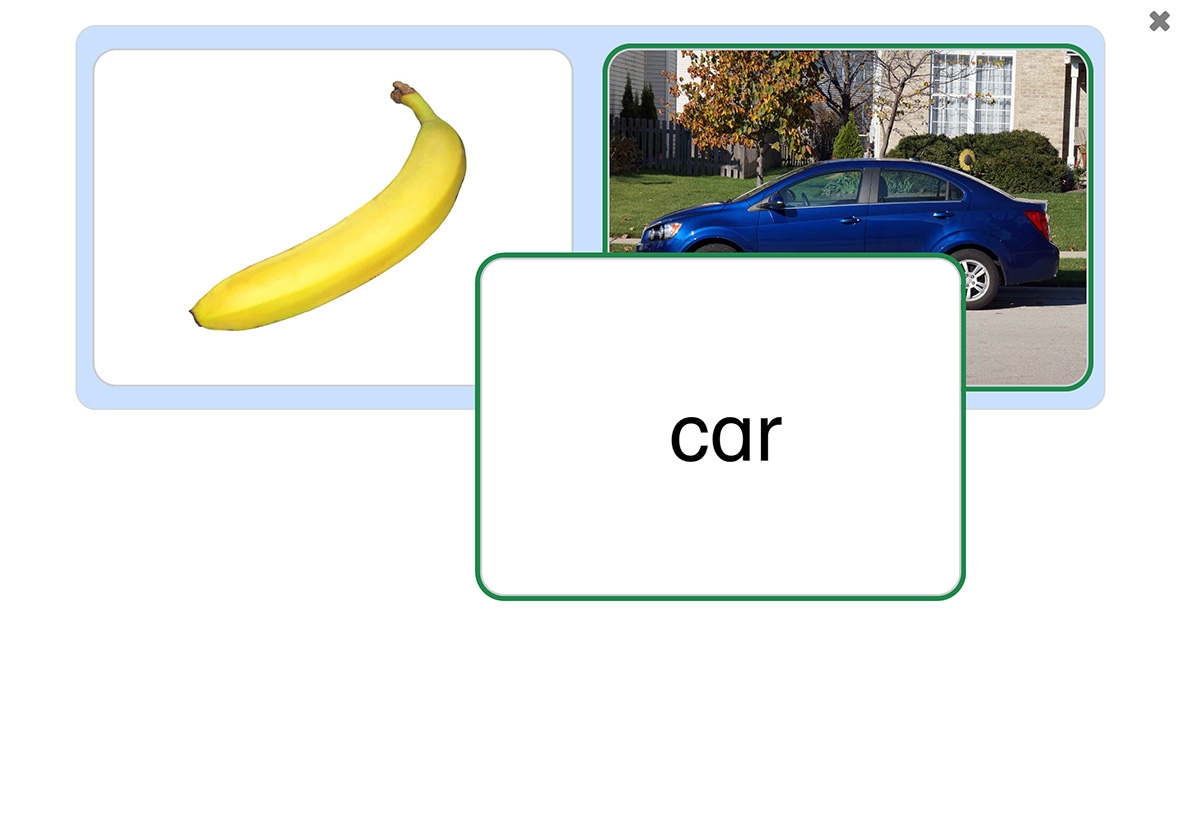

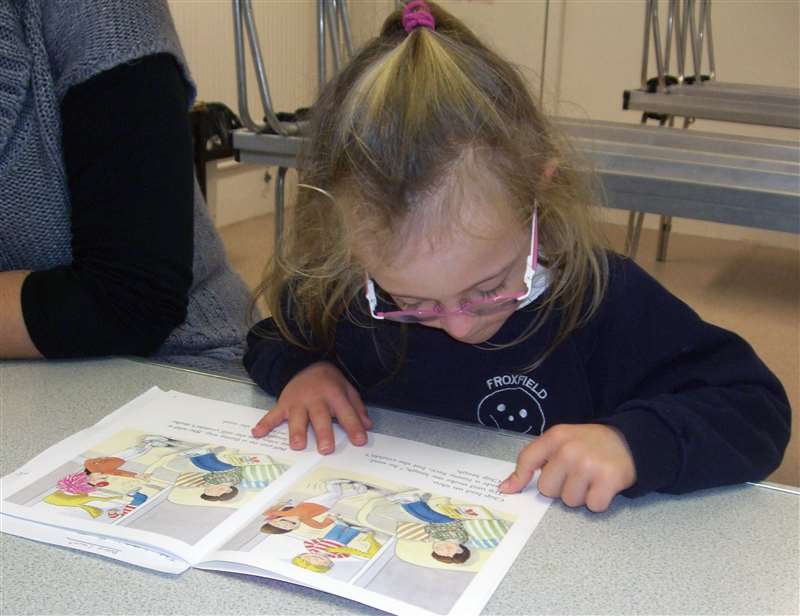

Reading and Language Intervention (RLI)

The Reading and Language Intervention for children with Down Syndrome (RLI) is an evidence-based teaching programme designed for children with Down syndrome aged 5 to 11 years.

Training courses

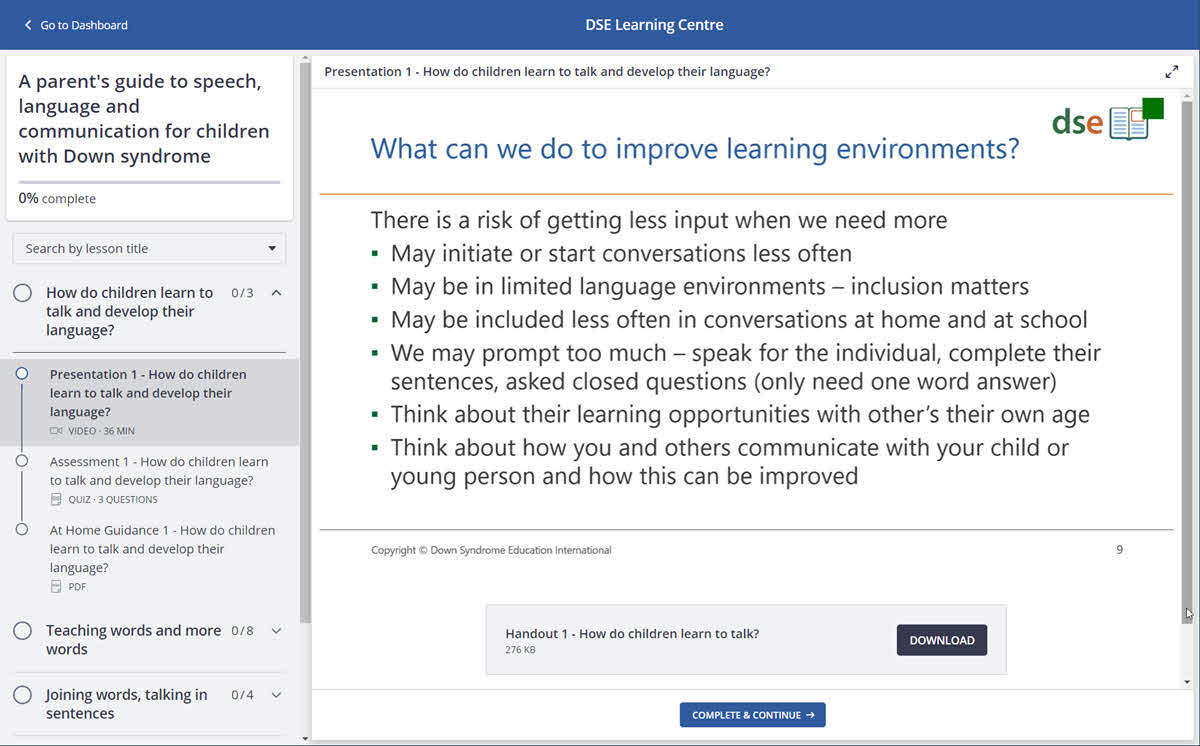

Our training courses offer comprehensive information and guidance across all areas of early development and school education. We offer courses for parents, teachers and teaching assistants and speech and language therapists.

Down Syndrome Research Forum 2024

The Down Syndrome Research Forum 2024 will be held online on 25 and 26 April.

The Down Syndrome Research Forum is an established, international meeting of researchers and practitioners interested in advances in our understanding of how to best meet the developmental and educational needs of children with Down syndrome.